How to beat the broadband price hikes

Customers are facing inflation-busting rises – so here is how to find a better deal

Broadband and mobile phone customers are facing above-inflation mid-contract price hikes of up to 8.8% this spring following the latest inflation data.

"Most of the biggest broadband and mobile providers" link annual bill increases to either December's Consumer Prices Index (CPI) or the January Retail Prices Index (RPI) rates of inflation, said MoneySavingExpert.

The January RPI rate – published in February – was 4.9%, "so we know the hikes that all of the major providers will implement".

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Many companies also add around 3%, said uSwitch, which they claim helps "combat rising business costs".

Virgin Media links its price hikes to the "more expensive type of inflation", added the comparison website, at RPI plus 3.9%, while others such as BT, EE, Three and Vodafone use CPI plus 3.9%.

The "inflation-busting" increases will take place from next month until May, said This Is Money. Providers say their "hands are tied" as most of them rely on Openreach's infrastructure and pay a yearly fee, which rises with inflation as well.

To add "insult to injury", said Which?, Virgin Media and O2 raised customer bills by an average of 13.8% and 17.3% respectively last year. Customers of these brands who signed up or renewed contracts since 8 February won't see price increases until April 2025.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Industry regulator Ofcom has announced that it is planning to ban mid-contract price rises but until this happens, there are ways to avoid the price hikes.

Check your contract

Check your terms and conditions, said GoCompare, because if the price "has increased unexpectedly and you are out of contract" you have the right to cancel without "hefty fees".

Also, you don't have to accept a price hike "if it's not part of your contract", added the comparison website.

Shop around

These hikes affect only those people who are in a contract, so if yours has ended then you are "free to leave" without penalties, added MoneySavingExpert.

People can often "save £100s by switching", so it is worth shopping around for the best deal.

Haggle

It may be worth haggling for a better deal if you are out of contract but want to remain with your current provider, said Rest Less.

"Leverage your right to leave penalty-free if you are out of contract," the website added, and they may offer a "better rate to convince you to stay".

Ask for help

Providers are required to support struggling customers.

Speak to your provider, said Which?, if you "have concerns about being able to pay your bills".

Many of the large providers such as BT, Sky and Vodafone have schemes in place, added MoneySavingExpert, "to help customers who've encountered financial problems".

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

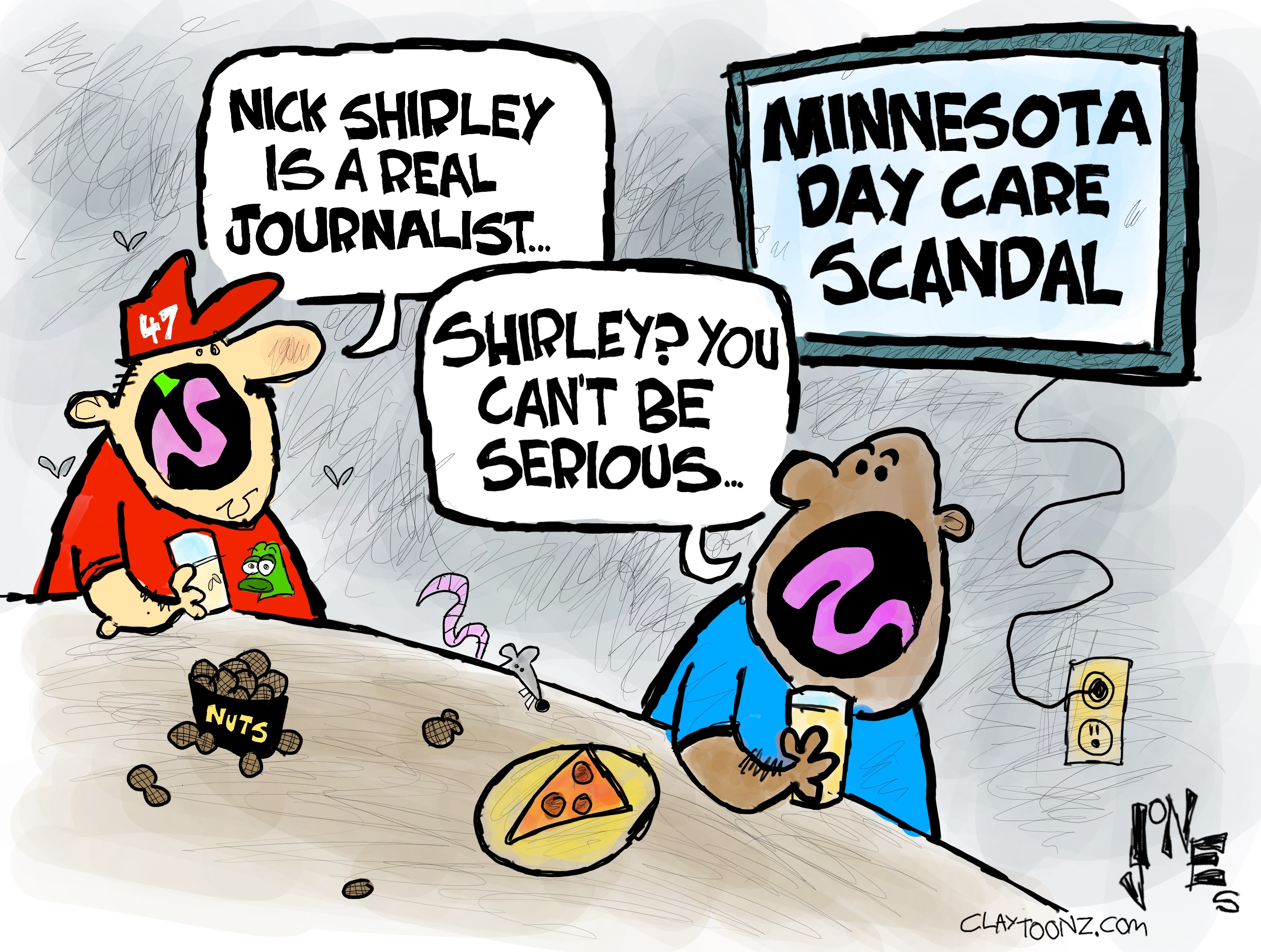

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency

-

How to financially prepare for divorce

How to financially prepare for divorceThe Explainer Facing ‘irreconcilable differences’ does not have to be financially devastating

-

Why it’s important to shop around for a mortgage and what to look for

Why it’s important to shop around for a mortgage and what to look forThe Explainer You can save big by comparing different mortgage offers

-

4 ways to save on rising health care costs

4 ways to save on rising health care costsThe Explainer Health care expenses are part of an overall increase in the cost of living for Americans

-

4 ways to streamline your financial life in 2026

4 ways to streamline your financial life in 2026the explainer Time- and money-saving steps

-

4 tips to safeguard your accounts against data breaches

4 tips to safeguard your accounts against data breachesThe Explainer Even once you have been victimized, there are steps you can take to minimize the damage

-

Received a windfall? Here is what to do next.

Received a windfall? Here is what to do next.The Explainer Avoid falling prey to ‘Sudden Wealth Syndrome’

-

How to save more for retirement next year

How to save more for retirement next yearthe explainer Secure yourself a suitable nest egg

-

Who will the new limits on student loans affect?

Who will the new limits on student loans affect?The Explainer The Trump administration is imposing new limits for federal student loans starting on July 1, 2026