Why is crypto crashing?

The sector has lost $1 trillion in value in a few weeks

Crypto is supposedly the currency of the future, but it is not doing so well presently. The sector has lost more than $1 trillion in value over the last few weeks.

The crypto industry is having a “terrible, horrible, no good, very bad month,” said USA Today. Bitcoin has lost more than 10% of its value for the year, dropping from a high of $126,000 in October to under $90,000 last week. The drop in digital currency values is due to a “whirlwind of factors” that include shaky showings for artificial intelligence and technology stocks amid growing concerns about the overall economy. “No one can say” when the dust might settle.

“It was supposed to be crypto’s year,” said The Wall Street Journal. Since 2025 brought a “crypto-loving White House, Wall Street adoption and friendly legislation,” it seemed poised to erase the industry’s regulatory obstacles. Instead, the “sky-high expectations of a golden age” have foundered. Cryptocurrency’s original reputation was as an “antiestablishment asset” coming out of the Great Recession. Now the sector is trying to “go legit” but having trouble shedding its standing as the “deranged, foul-mouthed little sibling of Wall Street.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What did the commentators say?

“Brutal” selloffs in the crypto sector happen “every few years, or whenever sentiment snaps,” said Emily Nicolle at Bloomberg. But those previous cycles did not match the “speed and scale” of crypto’s collapse in recent weeks. The difference this time is that crypto is now “woven into the fabric of Wall Street and the broader public markets.” That means its fate is now “tied to AI-fueled market optimism.” Amid growing fears of an AI bubble, though, it does not take much prompting to “spook investors into selling.”

Crypto in recent years has gone from an “object of mockery” to “broadly accepted, even encouraged” by mainstream financial institutions, said The Economist. That victory actually poses a problem. The “wider acceptance” has deepened crypto’s links to the broader financial markets, so that the “pain from a crypto crash will be felt more widely than in the past.” A government intervention seems remote, but “surprises can never be ruled out” in politics and in crypto.

What next?

Crypto believers see it as a “safe store of value against inflation and rising national debt,” said Marketplace. But the current instability comes amid “sticky inflation and a rising national debt.” The sector’s growing acceptance on Wall Street means your 401(k) probably includes some crypto stock. If the downturn lasts, that would produce “some knock-on effects on spending” in the broader economy, said Columbia Law School lecturer Todd Baker to the outlet.

There are now some fears of a “crypto winter,” said MarketWatch. But other observers say the sector is likely still in solid shape for the long term, thanks to its integration with financial markets. Banks like J.P. Morgan now accept crypto assets as collateral. We are not seeing a crypto winter, said Frontier Investments CEO Louis LaValle. “I think we’re watching bitcoin grow up.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

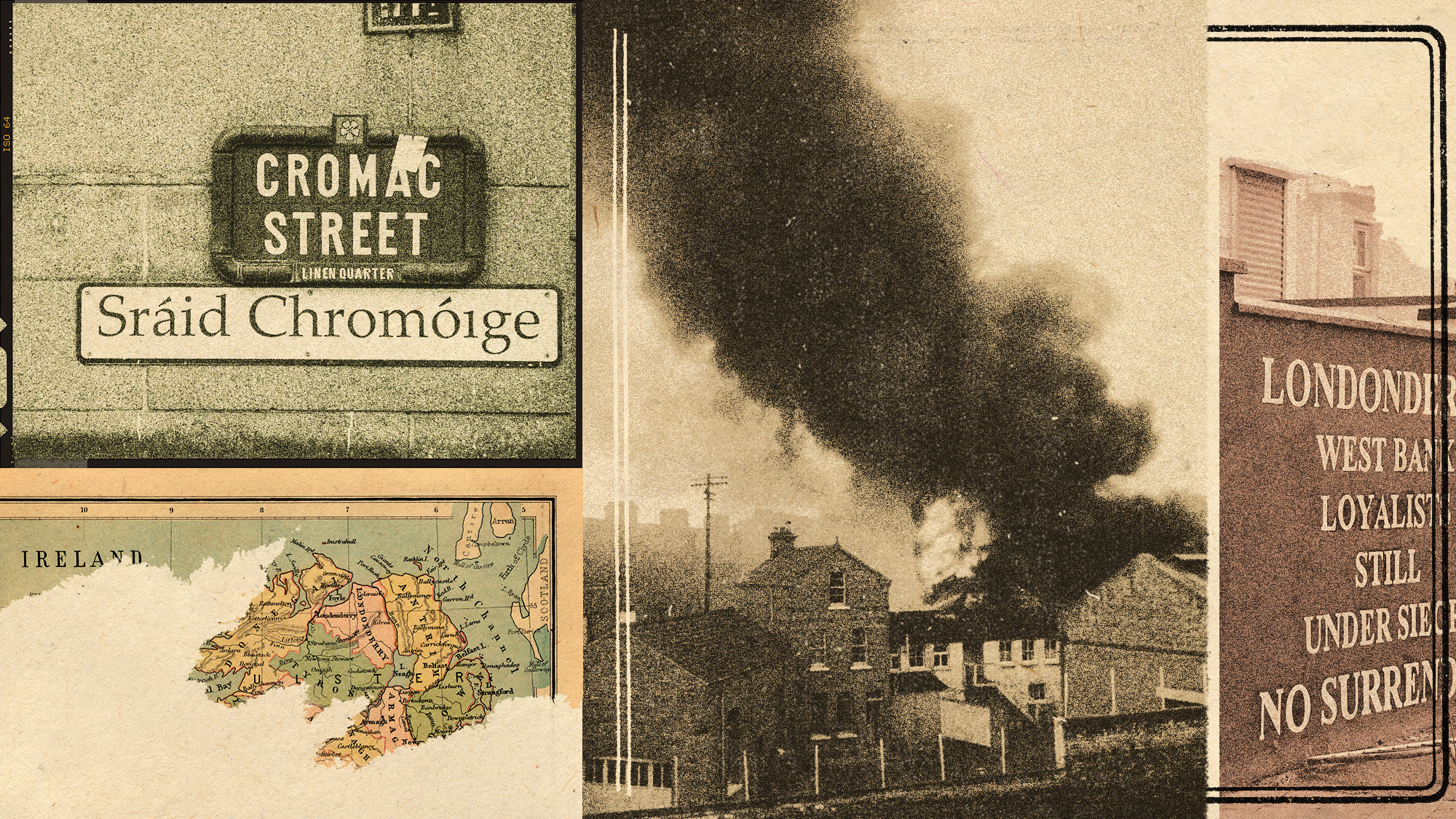

The battle over the Irish language in Northern Ireland

The battle over the Irish language in Northern IrelandUnder the Radar Popularity is soaring across Northern Ireland, but dual-language sign policies agitate division as unionists accuse nationalists of cultural erosion

-

Villa Treville Positano: a glamorous sanctuary on the Amalfi Coast

Villa Treville Positano: a glamorous sanctuary on the Amalfi CoastThe Week Recommends Franco Zeffirelli’s former private estate is now one of Italy’s most exclusive hotels

-

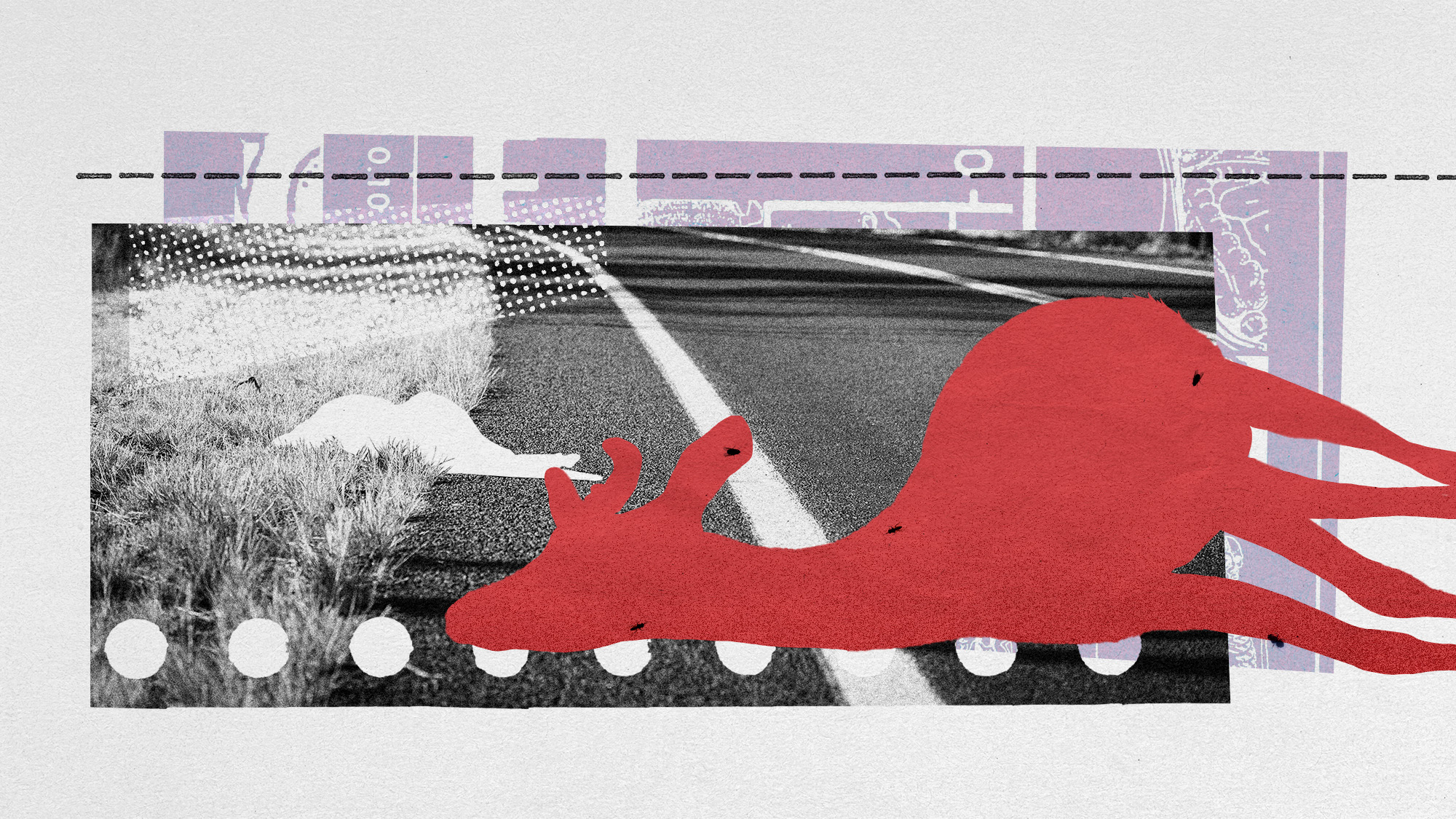

How roadkill is a surprising boon to scientific research

How roadkill is a surprising boon to scientific researchUnder the radar We can learn from animals without trapping and capturing them

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Can Trump make single-family homes affordable by banning big investors?

Can Trump make single-family homes affordable by banning big investors?Talking Points Wall Street takes the blame

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

The longevity economy booms as people live longer

The longevity economy booms as people live longerThe Explainer The sector is projected to reach $27 trillion by 2030

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

Employees are branching out rather than moving up with career minimalism

Employees are branching out rather than moving up with career minimalismThe explainer From career ladder to lily pad

-

Who will be the next Fed chair?

Who will be the next Fed chair?Today's Big Question Kevin Hassett appears to be Trump’s pick