Why does the US need China's rare earth metals?

Beijing has a 'near monopoly' on tech's raw materials

China has upped the ante in its trade war with the United States. Beijing last week imposed export controls on "rare earth" minerals, key elements in the production of technology for your kitchen, car, high-tech military weapons and more.

"Everything you can switch on or off likely runs" on the minerals, said Thomas Kruemmer, the director of Ginger International Trade and Investment, to BBC News. One of the rare earths, neodymium, is used in "loudspeakers, computer hard drives, EV motors and jet engines." Others are used to "manufacture television and computer screens." The minerals are "abundant" in nature, said the BBC, but they are they are "very hazardous to extract." And right now, China has a "near monopoly" on the market.

What did the commentators say?

The export blocks could "cause shutdowns in automotive production," said the Financial Times. They also "threaten Washington's military primacy," said Chatham House, a British think tank. The minerals are critical in the production of the F-35 fighter, as well as "robotics, drones, electric vehicles and touch screens." The trade war could end up giving Beijing a "crucial strategic advantage in long-term U.S.–China competition for military and technological supremacy."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

President Donald Trump may think "he'll find alternative sources of rare earths," said Nicholas Kristof at The New York Times. It will be difficult: America relies on China for 72% of its rare earth metals supply. And ramping up domestic production will not be easy either. Rare earths are "polluting to mine and process," which is why it can take "nearly three decades to get permission to open and operate a rare-earth mine in America." That gives the U.S. a steep challenge. Trump's trade war "seems destined to fracture our alliances and magnify American weakness."

Some worry the trade war could lead to a shooting war. "It is worth remembering how World War II began in the Pacific," said James Stavridis, a retired Navy admiral, at Bloomberg. Nearly a century ago, trade sanctions "cut off Japan from vital resources" like steel, oil and rubber. Pearl Harbor was the culmination of "economic disputes and provocative steps." Beijing's decision to block rare earth exports could be a new "indicator of impending conflict."

What next?

The challenges are immediate, while any potential solutions are off in the future. "Trump is trying to clear the way" for new U.S. mines, said The Associated Press, but any new home-grown operation is "years away." There is a single American mine for rare earth minerals, and its executives are fielding phone calls "from anxious companies" following China's announcement. The effects of the export block "have been immediate," said Matt Sloustcher, a spokesperson for MP Materials. Existing stockpiles should keep American manufacturers operating for now, said the AP, but "shortages may emerge later this year."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.

-

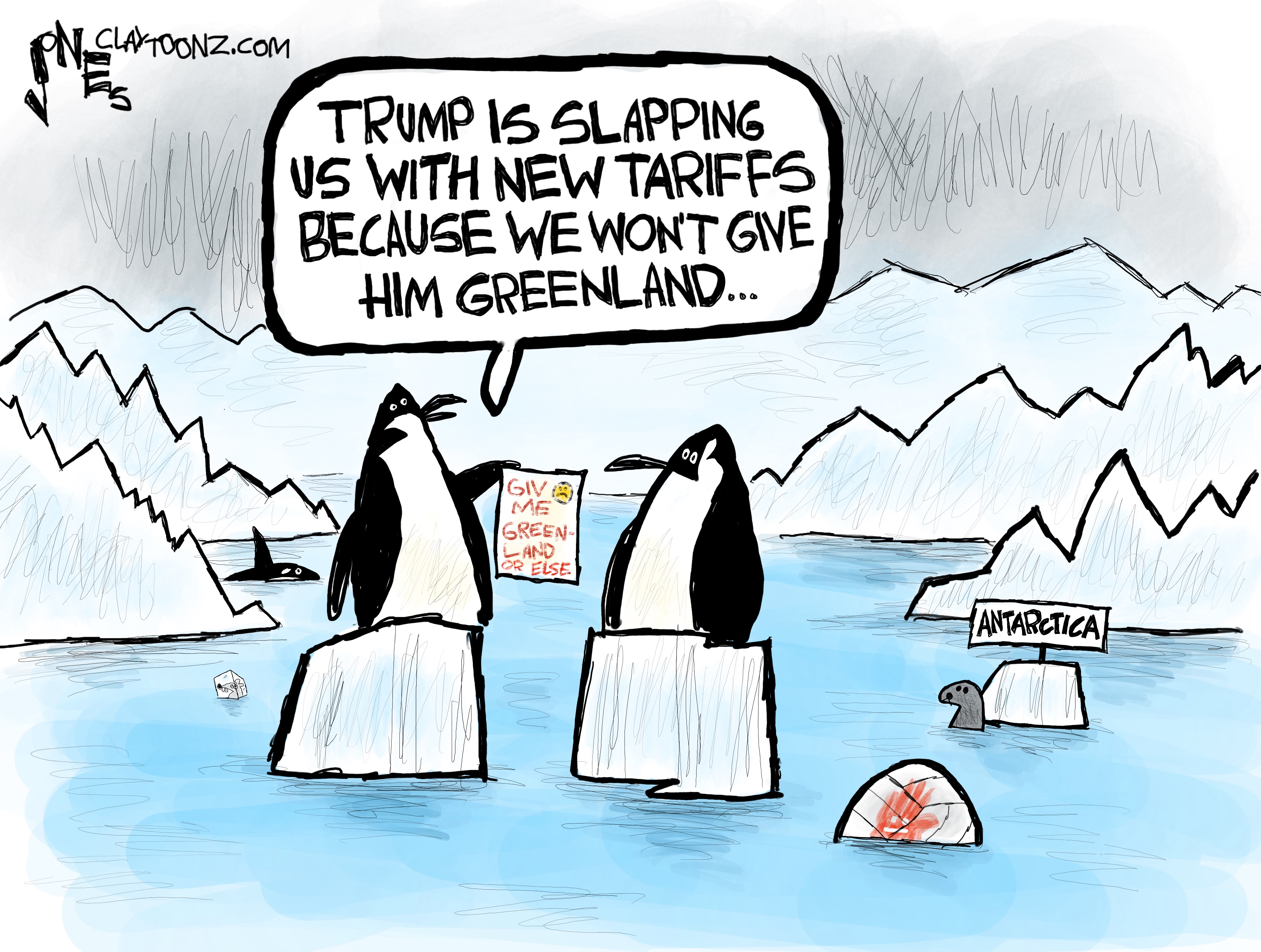

Political cartoons for January 19

Political cartoons for January 19Cartoons Monday's political cartoons include Greenland tariffs, fighting the Fed, and more

-

Spain’s deadly high-speed train crash

Spain’s deadly high-speed train crashThe Explainer The country experienced its worst rail accident since 2013, with the death toll of 39 ‘not yet final’

-

Can Starmer continue to walk the Trump tightrope?

Can Starmer continue to walk the Trump tightrope?Today's Big Question PM condemns US tariff threat but is less confrontational than some European allies

-

Will Trump’s 10% credit card rate limit actually help consumers?

Will Trump’s 10% credit card rate limit actually help consumers?Today's Big Question Banks say they would pull back on credit

-

What will the US economy look like in 2026?

What will the US economy look like in 2026?Today’s Big Question Wall Street is bullish, but uncertain

-

Tariffs have American whiskey distillers on the rocks

Tariffs have American whiskey distillers on the rocksIn the Spotlight Jim Beam is the latest brand to feel the pain

-

The longevity economy booms as people live longer

The longevity economy booms as people live longerThe Explainer The sector is projected to reach $27 trillion by 2030

-

How will China’s $1 trillion trade surplus change the world economy?

How will China’s $1 trillion trade surplus change the world economy?Today’s Big Question Europe may impose its own tariffs

-

Texas is trying to become America’s next financial hub

Texas is trying to become America’s next financial hubIn the Spotlight The Lone Star State could soon have three major stock exchanges

-

Employees are branching out rather than moving up with career minimalism

Employees are branching out rather than moving up with career minimalismThe explainer From career ladder to lily pad

-

Who will be the next Fed chair?

Who will be the next Fed chair?Today's Big Question Kevin Hassett appears to be Trump’s pick