529 college savings plans are everything that is wrong with American policy

They're awful and don't work — and we can't get rid of them

President Obama suffered a minor political setback this week, when a proposal to end the 529 college savings tax credit, unveiled during the recent State of the Union address, sparked a backlash. He has now dropped the proposal.

On one level, it's no big deal, since it's only a small policy, letting people build college savings accounts without being taxed. It's also vanishingly unlikely he could have gotten anything through Congress. But on another, it's an extremely frustrating example of the limitations of American political discourse.

So, let's be clear: the 529 tax credit is a piece of utter trash policy. Few people use it, those who do are mostly wealthy and don't even save very much, its effectiveness varies wildly based on when you start investing, and tax breaks on savings are a lousy way to subsidize higher education in the first place. The fact that we can't even consider getting rid of this steaming garbage pile — and there are dozens like it in the tax code — does not bode well for the American system.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

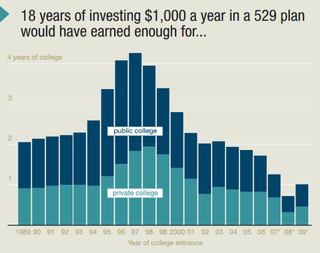

The think tank Ed Sector has a paper laying out most of the big problems with 529s. Like a 401(k), the money is usually invested in a mutual fund. But since the money is saved for a relatively short period and needed at the exact moment your child enters college (unlike a retirement account, which is typically saved over 40 years and can be delayed), 529s are highly vulnerable to market fluctuations. If your daughter started school in 1997, and you had been saving $1,000 per year for the previous 18 years, your 529 would have covered four years of public school. But if she started in 2008, your 529 would have covered less than one year.

Worse, stock market collapses are usually correlated with general economic weakness, when cash-strapped state governments often jack up college tuition. If your kid graduated in 2000, account growth of 236 percent would easily cover tuition increase of 13.6 percent at public school. But if your kid graduated in 2010, account growth of a measly 14 percent would not have touched a tuition increase of 19 percent.

In other words, 529s work best when they're least needed, and fall to pieces when they're needed most.

Like most tax expenditures, they also funnel most of their benefits to the rich. In Kansas in 2007, 81 percent of 529 benefits went to families making more than $100,000, and 37 percent to those making over $250,000 — the top one percent of families there. They don’t just break down at the worst possible time, they’re also pay out benefits inversely to need.

Similar to 401(k)s, people aren't saving nearly enough. The average account has enough to pay for about one year of public school. It's a safe assumption that the poorer the account holder, the less they have in it. Also like 401(k)s, 529s have spawned a cottage industry of swindlers who trick people into investing into high-fee accounts.

Finally, there is a fundamental problem with subsidizing these sorts of purchases with individual savings benefits: colleges may just raise prices to capture them, creating a vicious cycle of price gouging and desperate saving. The howls of outrage from centrist upper-middle-class commentators that greeted Obama's announcement often featured arguments that making $150,000 is not that much because college is so expensive. Funny how that works out!

The U.S. tax code is punched through with dozens of these kind of tax expenditures: the mortgage interest deduction, lower rates on capital gains, the carried interest loophole, retirement credits, and so on. Even the ones that are designed to promote social goods like health insurance are horribly inefficient.

Effectively, these are programs to distribute money to the rich that purchase political cover by cutting the upper middle class in on a tiny fraction of the goodies (the poor, of course, get essentially nothing). But as we've seen, even small and exceptionally terrible policies like 529s are politically untouchable. The prospects for meaningful tax reform are dim indeed.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

'Elevating Earth Day into a national holiday is not radical — it's practical'

'Elevating Earth Day into a national holiday is not radical — it's practical'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

UAW scores historic win in South at VW plant

UAW scores historic win in South at VW plantSpeed Read Volkswagen workers in Tennessee have voted to join the United Auto Workers union

By Peter Weber, The Week US Published

-

Today's political cartoons - April 22, 2024

Today's political cartoons - April 22, 2024Cartoons Monday's cartoons - dystopian laughs, WNBA salaries, and more

By The Week US Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published