Politics is undermining our economy

We could reduce unemployment — if only Washington wanted to

There is a line of argument that I do not understand — even though it is made by economists I respect. It is that our current labor-market depression was baked in the cake from the moment that Alan Greenspan decided to keep interest rates low in the early 2000s, declining to stop would-be homeowners from borrowing from would-be mortgage lenders who were eager to lend. I disagree. I think that our current labor-market depression was baked in the cake when we started electing leaders who put other political and policy objectives far in advance of maintaining full employment.

Economist Dean Baker's formulation of what I call the household-balance-sheet-recession argument goes roughly as follows: The housing boom created some $8 trillion of fictitious housing wealth — wealth that people thought they had because they believed they would be able to sell their homes at inflated prices. When housing prices collapsed, home owners realized that they were a lot poorer than they had thought. They cut back their spending on consumer goods by $1 trillion a year, and that is the source of our current downturn and high unemployment. With no way to recreate the $8 trillion of fool's gold that was the housing bubble, there is no way to get American consumers spending again. So we were doomed to undergo this depression from the moment Greenspan failed to choke off the housing bubble.

Our economic problem isn't structural, it's political

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But this argument seems wrong to me. Consumers are not the only spenders in the economy. Businesses can spend as well to boost their productive capacity — although it would be hard to get businesses to spend much to expand their factories if they don't foresee the consumer spending to make those factories profitable. Exporters can lend money abroad to finance the purchase of U.S.-made goods and so pile up wealth in the form of money owed to us by foreigners. The government can borrow-and-spend, and if it spends wisely on human and physical infrastructure to boost our national wealth then it will have no problem repaying its debts in the future.

Yes, the collapse of the housing boom and the consequent $8 trillion reduction in household wealth does mean that consumer spending will be significantly below trend for quite a while to come. But when the consumer stops spending and sits down, the government and the exporter — and also the capacity-building business — can stand up: There is no chain of logical necessity leading from the collapse of the housing boom to a prolonged period of very high unemployment.

U.S. households want to save? Then let them save. And let businesses invest in productive capital, let the government invest in infrastructure, and let exporters invest in wealth claims abroad. The re-attainment and maintenance of full-employment, an a commensurate level of aggregate demand, should not be a problem as long as the federal government is willing to spend enough on building infrastructure and human capital, as long as the Federal Reserve can promise markets that it will keep real interest rates low enough for long enough to make building business capacity a no-lose bet, and as long as the Treasury is willing to let the value of the dollar fall far enough that America's exporters can offer foreigners attractive deals on the goods and services we make.

Of course, if boosts to economy-wide spending led to inflation instead of increases in capacity utilization, then we would have a very big problem; we would be in the alternative universe of the Hayekians in which we have a fundamental mismatch between the skills of our labor force and the goods wanted by consumers. But there are no signs that we are in that alternative universe — no signs at all.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What, then, is our immediate problem?

It is political.

The Federal Reserve would rather let unemployment remain above 8 percent for a good long while than run the slightest risk of higher inflation. The Treasury would rather let unemployment remain above 8 percent for a good long while than say that a strong dollar is not in America's interest (even though it is not). The Republican decision-makers in Congress would rather let unemployment remain above 8 percent for a good long while than let Obama win legislative victories.

Most puzzling, the Obama administration would rather let unemployment remain above 8 percent for a good long while than make what it thinks is likely to be an unsuccessful push that will reveal its lack of control over the government. Perhaps they are right that they have pushed the envelope as far as they can go with respect to Congressional action (although not as far as they could have with quantitative easing, loan guarantees or mortgage restructuring via the Treasury). But until you push, you do not really know. And back in the late 1940s Harry Truman welcomed the opportunity to run against the Republican Congress to say that these were the policies he advocated, and he was sorry that the do-nothing Congress would not pass them. The Obama administration seems to feel differently. It's as if they dare not strip off the mask of competence and control to show the conflicted face beneath.

The current jockeying on competing budgets is yet additional proof of our political dysfunction. Our urgent problem right now is 9 percent unemployment. We need investment to speed productivity and income growth — and we need it soon. In the long run, we need to control health care program costs.

A game of budget chicken does not bring us closer to achieving these goals.

Create an account with the same email registered to your subscription to unlock access.

Brad DeLong is a professor in the Department of Economics at U.C. Berkeley; chair of its Political Economy major; a research associate at the National Bureau of Economic Research; and from 1993 to 1995 he worked for the U.S. Treasury as a deputy assistant secretary for economic policy. He has written on, among other topics, the evolution and functioning of the U.S. and other nations' stock markets, the course and determinants of long-run economic growth, the making of economic policy, the changing nature of the American business cycle, and the history of economic thought.

-

AI is causing concern among the LGBTQ community

AI is causing concern among the LGBTQ communityIn the Spotlight One critic believes that AI will 'always fail LGBTQ people'

By Justin Klawans, The Week US Published

-

'Modern presidents exercise power undreamed of by the Founding Fathers'

'Modern presidents exercise power undreamed of by the Founding Fathers'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

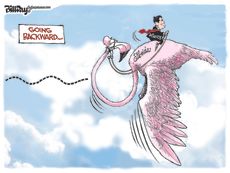

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

3 reasons to feel good about the economy

3 reasons to feel good about the economyfeature The unemployment rate remains stubbornly high, and D.C. is mired in a debt-ceiling stalemate. But it's not all bad

By David Frum Last updated

-

It's still all about the economy

It's still all about the economyfeature Bin Laden's death swamped an anemic economic report. That's bad news for America — and for Obama's chances of re-election

By Edward Morrissey Last updated

-

The economy trumps Trump

The economy trumps Trumpfeature Obama has deflected the birthers. The real danger for the president now is the GOP's political ploy to dead-end the economy

By Robert Shrum Last updated

-

Britain proves the folly of GOP economics

Britain proves the folly of GOP economicsfeature First slash spending. Then watch the economy contract

By Robert Shrum Last updated

-

We need a dose of inflation

We need a dose of inflationfeature William Jennings Bryan was a crank, but he understood in the 1890s that deflation is more dangerous than cheap money. It still is

By David Frum Last updated

-

David Brooks' neo-Hooverite plea

David Brooks' neo-Hooverite pleafeature The conservative N.Y. Times columnist is politely asking Obama to ignore basic economics, ignore the bond markets, and ignore Nobel laureate Paul Krugman — and to please steer the economy into a ditch

By Robert Shrum Last updated

-

Is the economy a victory or a defeat?

feature Yes, we've averted the worst, but unemployment is at 10 percent. Assessing the economic recovery

By Brad DeLong Last updated

-

Afghanistan could decide this presidency

Afghanistan could decide this presidencyfeature Despite the false hopes of Republicans, Obama will prevail on health care and preside over a growing economy. The fateful test is Afghanistan.

By Robert Shrum Last updated