Is the U.S. still due for a painful credit downgrade?

Washington's last-minute deal might not slow down the ballooning growth of America's debt enough to please credit ratings agencies

Now that the House has passed a debt deal, and the Senate is preparing to vote on it Tuesday, the end of the feud over raising the debt ceiling is finally in sight. But financial experts warn that the agreement, which slashes trillions in spending, won't necessarily prevent at least one of the big three credit rating agencies — Standard & Poor's, Moody's, and Fitch — from downgrading America's top-notch AAA rating, a move that would make it more expensive for the government, and ordinary Americans, to borrow money. Should we all brace for a downgrade and the higher interest rates that will almost surely come with it?

Yes. The ratings agencies won't be satisfied with this deal: Politicians are crowing about how they're reducing the next decade's deficit by more than $2 trillion, says Stephen B. Meister in the New York Post, but their math assumes the massive Bush-era tax cuts will expire in 2013. Let's get real — most Republicans will "vigorously oppose" allowing that to happen. Plus, the ratings agencies know this eleventh-hour deal won't cure our addiction to borrowing — so "get ready to lose that AAA rating, Uncle Sam."

"Debt downgrade: still possible"

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The U.S. might have dodged a downgrade — but the economy is still in trouble: There's a chance the debt deal will be enough to prevent a downgrade, says Mohamed El-Erian, co-CEO of bond management firm Pimco, as quoted by CNBC. Standard & Poor's, which issued the sternest warnings during Congress' messy negotiations, is probably "under tremendous pressure not to downgrade" now that lawmakers have reached a deal. But regardless, the "debt ceiling debacle" and subsequent spending cuts will only be a drag on economic growth — which ultimately hurts America's efforts to create jobs and put the nation's finances in order.

"Debt deal will add to 'new normal' slowness: El-Erian"

Downgrade or no downgrade, the economy will survive: Even with a downgrade, if one comes, U.S. Treasury bonds will remain about the safest investment around, says The Economist. So there's no reason to fear that such a "well-signaled ratings drop" would cause a flight from U.S. bonds. In the end losing the coveted AAA rating might actually be a good thing for America, because once U.S. debt is no longer considered "risk-free," politicians will have to think twice before making "unsustainable spending commitments."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

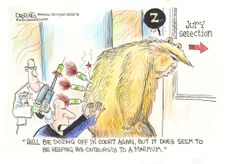

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published