JPMorgan's $9 billion loss: Proof the mega-bank threatens the economy?

The financial giant's loss from a single trade is swelling to gargantuan proportions, casting doubt on CEO Jamie Dimon's claims that his company is safe and sound

This week, The New York Times reported that JPMorgan Chase could lose up to $9 billion on a single trade, a huge escalation from the already-massive $2 billion that CEO Jamie Dimon had initially estimated. When the botched trade was first disclosed in May, it stoked fears that Wall Street banks were engaging in the type of casino-style risk-taking that brought the financial system to its knees in 2008. But Dimon insisted — notably during two congressional hearings — that the trade was an isolated incident and that Main Street had nothing to fear. Now, the latest report from The Times casts doubt on that claim, with one former banking regulator telling the paper, "Essentially, JPMorgan has been operating a hedge fund" with the money in its customers' checking accounts. Is this proof that JPMorgan is a threat to the economy?

Yes. JPMorgan is a disaster waiting to happen: JPMorgan's swelling loss underscores the fact that "the banking industry has become its own worst enemy," says Doug Kass at The Street. JPMorgan has engaged in a "relentless abuse of power and the aggressive use of client deposits in risk-taking strategies" that can only be curbed by tough government regulation. A financial industry that has "grown too influential by virtue (or lack thereof) of its nearly unlimited powers" could be deadly to the economy.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Clearly, mega-banks need more conservative approaches: JPMorgan and the "big Wall Street banks are all opaque black boxes" that could be exposed to huge amounts of risk, says Paul R. La Monica at CNNMoney. Banks these days are "insanely complex," and it's easy to imagine them getting burned in this "still murky world of credit default swaps and derivatives," particularly if they have investments in troubled European banks. "Call me a traditionalist, but I like it when banks simply loan money and take deposits." It certainly "beats billion dollar losses any day of the week."

"Big banks are a big mess. Run away!"

And Jamie Dimon should be fired: Dimon ought to be "picked up by the seat of the pants and scruff of the neck and thrown out of his corner office," says Marek Fuchs at The Street. "Slick Jamie" has been getting by on a "nearly inexplicable sense of invincibility," charming "the pants off of the media, traders, and politicians in Washington testimony." With this new $9 billion estimate, it's doubtful that Dimon "has been forthright or, worse, even aware" of what's going at JPMorgan. "That calls into question his future leadership."

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

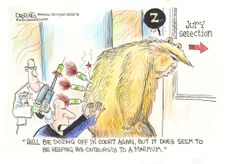

5 sleeper hit cartoons about Trump's struggles to stay awake in court

5 sleeper hit cartoons about Trump's struggles to stay awake in courtCartoons Artists take on courtroom tranquility, war on wokeness, and more

By The Week US Published

-

The true story of Feud: Capote vs. The Swans

The true story of Feud: Capote vs. The SwansIn depth The writer's fall from grace with his high-flying socialite friends in 1960s Manhattan is captured in a new Disney+ series

By Adrienne Wyper, The Week UK Published

-

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'

Scottie Scheffler: victory for the 'pre-eminent golfer of this era'Why Everyone's Talking About Masters victory is Scheffler's second in three years

By The Week Staff Published