Issue of the week: How Twitter fueled a market swoon

A fake report posted by hackers on the Associated Press Twitter feed caused the S&P 500 to drop 0.9 percent.

A single tweet can be enough to cause a stock market crisis, said Christopher Matthews in Time.com. We learned that last week, when hackers posted a fake report on the Associated Press Twitter feed claiming that Barack Obama had been injured in an explosion at the White House. The AP quickly flagged the tweet as fake, but not before it “sent shock waves through the market,” causing the S&P 500 to drop 0.9 percent and temporarily wiping out $136 billion in stock value. The real culprit behind this latest “flash crash” isn’t a hacker—it’s “the proliferation of high-frequency trading.” Wall Street firms use computer algorithms to make millions of trades per second, triggered by automated scans of news sources-—including Twitter—for specific words or phrases. They make money, but “when the going gets tough, these computers tend to sell quickly and run for the hills, actually reducing liquidity when the market needs it most.”

Don’t blow this out of proportion, said Jared Keller and Evan Applegate in Businessweek.com. Cases of false tweets and news reports wreaking havoc on the markets are rare. In 2011, for instance, Apple shares dipped just 1 percent (and quickly rebounded) after a false report said that Apple founder Steve Jobs had died. And when a Twitter account impersonating prominent short-seller David Einhorn tried to “induce fluctuations” in Herbalife’s stock in February, the company’s value underwent “no noticeable change.” Still, the AP episode “highlights the potential pitfalls of relying on social networks for tradable information,” especially on the heels of the Securities and Exchange Commission’s announcement that companies can use social media sites, including Twitter and Facebook, “to share market-moving company announcements.”

The solution is better security, said Caleb Garling in the San Francisco Chronicle. The First Amendment “prevents the government from controlling what users say on Twitter,” but regulators can make social media firms beef up their protocols. False information “has the potential to be damaging to more than the financial world.” Just imagine: “If the hacked AP tweet had been more believable and not as easy to discredit—say, ‘U.S. Navy moving into strategic positions around North Korea’—a global emergency could have ensued.” The technology sector may disdain regulation, but “other kinds of information, such as financial and health-care data, are already strictly regulated by law.” It’s up to the consumer to decide what to trust on Twitter, but messages shouldn’t be so easy to fake.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Other than self-restraint, which is in short supply these days, nothing much can be done to prevent any of this,” said George Packer in NewYorker.com. Social media sites will seek new means to “spread information, for better and worse, farther and faster than the Spanish flu.” And unless regulators crack down on high-frequency traders, they “will go on using algorithms that turn milliseconds of information advantage into huge profits”—even if that information is wrong.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

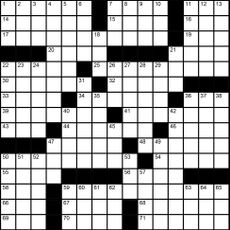

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine printables - May 3, 2024

Magazine printables - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Issue of the week: Do high-speed traders rig the market?

feature Wall Street is abuzz over high-frequency trading.

By The Week Staff Last updated

-

Issue of the week: How Yellen spooked the markets

feature At her first press conference, the new Federal Reserve chair made the mistake of indicating when the Fed would raise interest rates.

By The Week Staff Last updated

-

Stop calling women ‘bossy’

feature Let’s ban “She’s bossy.” Instead, let’s try, “She has executive leadership skills.”

By The Week Staff Last updated

-

Issue of the week: GM’s recall disaster

feature Mary Barra is facing “her first big test” since she took over as GM’s new CEO in January: a recall of more than 1.6 million vehicles.

By The Week Staff Last updated

-

Issue of the week: Who gets Fannie’s and Freddie’s profits?

feature Fannie Mae’s and Freddie Mac’s shareholders want their money back.

By The Week Staff Last updated

-

Issue of the week: Comcast buying Time Warner Cable

feature Has Comcast won the cable wars?

By The Week Staff Last updated

-

Issue of the week: AOL’s million-dollar babies

feature AOL’s “gaffe-prone” CEO, Tim Armstrong, “got in some hot water” last week.

By The Week Staff Last updated

-

Issue of the week: Why Google unloaded Motorola

feature Three years after shelling out $12.5 billion for Motorola, Google announced its sale to Lenovo Group for $2.9 billion.

By The Week Staff Last updated