10 things you need to know today: June 21, 2013

Stocks have their worst day of the year, FDA approves sale of Plan B pill without restrictions, and more

1. STOCKS HAVE THEIR WORST DAY OF THE YEAR

The Dow Jones Industrial Average took its steepest dive of the year on Thursday, losing 353 points a day after the Federal Reserve hinted it might end its bond-buying stimulus program later this year. The 2.3 percent drop followed heavy declines for stocks on Wednesday. "What the Fed's action did," said Paul Lambert of Insight Investment, "was to confirm that unless things in the U.S. get worse, then the music is going to be turned down at the party and the dancing is about to end." [Wall Street Journal]

………………………………………………………………………………

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. OBAMA MEETS WITH PRIVACY WATCHDOG OVER NSA SPYING

President Obama is meeting with members of a federal privacy oversight board on Friday as part of an effort to reassure Americans that their rights are not being violated by National Security Agency data-mining programs outlined in documents leaked by former contractor Edward Snowden. The security firm that vetted Snowden is now under investigation, and an Icelandic businessman linked to WikiLeaks has offered to fly Snowden from Hong Kong, where he is hiding, if he gets asylum. [Reuters]

………………………………………………………………………………

3. SECURITY SURGE DEAL BOOSTS IMMIGRATION OVERHAUL'S CHANCES IN THE SENATE

The Senate on Thursday took what could be a key step toward passing a comprehensive immigration reform bill when senators reached a deal that would almost double the number of federal agents along the U.S.-Mexico border. The agreement also called for construction of 700 miles of border fencing and providing money for aerial drones. The amendment all but ensures strong GOP support for the so-called Gang of Eight's bill, which is expected to be approved next week. [Washington Post]

………………………………………………………………………………

4. PALESTINIAN PRIME MINISTER ABRUPTLY SUBMITS HIS RESIGNATION

Palestinian Authority Prime Minister Rami Hamdallah has submitted his resignation after just two weeks in office. Palestinian officials said President Mahmoud Abbas would decide Friday whether to accept the resignation. Hamdallah has been caught up in a power struggle with two deputies, Muhammad Mustafa and Ziad Abu Amr, who were appointed by Abbas, and one source told the Jerusalem Post that Hamdallah is showing he is unwilling to be "a yes-man with no powers." [Jerusalem Post]

………………………………………………………………………………

5. FDA APPROVES SALE OF MORNING-AFTER PILL WITHOUT PRESCRIPTION OR AGE RESTRICTIONS

The Food and Drug Administration on Thursday approved sales of the emergency contraceptive Plan B One-Step without a prescription, to women and girls of all ages. The Obama administration had signed off on allowing access without a prescription, but fought to limit purchases to women over 15. A federal judge ordered the administration to remove all restrictions, which women's health advocates have demanded for a decade to help prevent unwanted pregnancies. [Los Angeles Times]

………………………………………………………………………………

6. ALL-FEMALE JURY SELECTED IN ZIMMERMAN TRIAL

After nine days of questioning, six jurors — all women — were chosen Thursday for George Zimmerman's trial in the shooting death of Florida teen Trayvon Martin last year. "This is probably as critical if not more critical than the evidence," Zimmerman's attorney, Mark O'Mara, said. Zimmerman, 29, who is charged with second-degree murder, has pleaded not guilty. He says he shot Martin, who was 17, in self-defense after being attacked. [USA Today]

………………………………………………………………………………

7. FLOODS FORCE AS MANY AS 100,000 CANADIANS TO FLEE

With unprecedented floods hitting the western Canadian city of Calgary, local authorities ordered mandatory evacuations that could affect as many as 100,000 people early Friday. "Gather your valuables and go," Calgary Mayor Naheed Nenshi told people in the flood zones. The levels of the Bow and Elbow rivers are expected to remain at peak levels until late Saturday. "I have never experienced any flooding of this magnitude," emergency management director Bruce Burrell said. [CBC, CNN]

………………………………………………………………………………

8. BRAZIL PROTESTS GROW DESPITE CONCESSION

Hundreds of thousands of Brazilians took to the streets in 100 cities on Thursday in the biggest demonstrations the South American nation has seen since an outburst of public anger triggered by public transportation fare hikes. The broadening of the protests came even though the mayors of Brazil's largest cities — Sao Paulo and Rio de Janeiro — announced a day earlier that they were reversing the fare increases. Even the ruling Workers Party ordered its members to join in. [Wall Street Journal]

………………………………………………………………………………

9. GANDOLFINI AUTOPSY RESULTS DUE FRIDAY

Relatives of the late Sopranos star James Gandolfini arrived Friday at the morgue where his body was taken after he was pronounced dead on arrival at a Rome hospital. Autopsy results are expected within hours, but an emergency room physician confirmed that Gandolfini, 51, appeared to have died of a heart attack. Details of what happened continued to emerge — staff at Gandolfini's hotel broke through a bathroom door after Gandolfini didn't answer his son's knocks. [CNN]

………………………………………………………………………………

10. HEAT WIN NBA CHAMPIONSHIP

The Miami Heat beat the San Antonio Spurs 95-88 in game seven of the NBA finals Thursday night to win their second straight championship. Heat forward Shane Battier, who had struggled in the post-season, chipped in six critical three-point shots. But Heat superstar LeBron James scored 37 points — capped by a game-clinching jumper with 27 seconds left — and became only the third player in NBA history, after Bill Russell and Michael Jordan, to be named Finals MVP two years in a row. [Washington Post]

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

'Republicans want to silence Israel's opponents'

'Republicans want to silence Israel's opponents'Instant Opinion Opinion, comment and editorials of the day

By Harold Maass, The Week US Published

-

Poland, Germany nab alleged anti-Ukraine spies

Poland, Germany nab alleged anti-Ukraine spiesSpeed Read A man was arrested over a supposed Russian plot to kill Ukrainian President Zelenskyy

By Peter Weber, The Week US Published

-

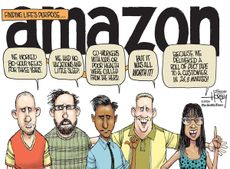

Today's political cartoons - April 19, 2024

Today's political cartoons - April 19, 2024Cartoons Friday's cartoons - priority delivery, USPS on fire, and more

By The Week US Published